Banco De Moambique SWIFT Codes Guide for Global Transfers

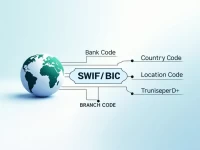

This article provides a detailed analysis of the SWIFT code BMOCMZMAXXX for Banco de Moçambique, the central bank of Mozambique. It explains the crucial role of SWIFT codes in international money transfers and offers practical guidance on finding and using them. Furthermore, it provides tips to avoid errors during the remittance process, aiming to assist readers in conducting secure and efficient cross-border money transfers. The article emphasizes the importance of accurate SWIFT code usage for successful international transactions.